UMBC is committed to fostering your financial wellness by preparing you to make good, and sound financial decisions along the way. This starts with proactively managing your student financial account. Keep in mind, your financial account is in your name, therefore, the outcome of this journey is yours, not your family’s.

Why is it important to keep my student financial account in good standing?

Managing your student financial account will help you maximize your opportunities:

- To Make Continuous Progress to Degree Completion: Timely registration is critical to timely degree completion as it ensures you are able to secure the classes you need (when you need them) to graduate on time. Your student financial account must be in good standing (i.e. no past due balances) in order to register for classes for any future term. Therefore, it is important to keep your account in good standing to avoid any delays in registration.

- To Access Your Official Transcript: Your transcript is your official record of your academic performance and your academic standing at the university. Graduate schools, scholarship programs, internships and employers often require an official transcript in order to verify your academic status and to consider you for educational and employment opportunities. Your student financial account must be in good standing in order to access your official transcript.

- To Access Your Diploma: Fact: Bachelor degree holders earn, over a lifetime, 1 million dollars more than those without a bachelor’s degree. Your diploma is a formal representation and display of your academic accomplishments and degree achievement. A new employer may require a copy of your diploma to verify your degree in order to finalize your employment status. Most importantly, after all your hard work – classes, projects, studying, etc. – you’ll want to proudly display your achievement! Your student financial account must be in good standing before a diploma can be issued to you.

- To Avoid Financial Penalties: Past due accounts are subject to late fees. These fees are typically 5% of the past due balance for the first month and can accrue up to $200. For example, if your past balance due is $1000, you will be assessed an additional $50 (5% of $1,000). Your total amount due now becomes $1050. Money used to cover late fees means less money to invest in other critical needs (food, clothing, shelter) or opportunities (savings and investments).

- To Avoid Collection Fees: In accordance with Maryland law, student financial accounts that are over 90 days past due are considered unpaid balances and are transferred to the Maryland Central Collections Unit (CCU). CCU will attempt to collect the unpaid balance on behalf of the State of Maryland and will assess a collection fee of 17% of the unpaid balance for their services. For example, if your transferred unpaid balance is $3,000, you will be assessed an additional $510 (17% of $3,000). Your total amount due at that point becomes $3,510. Collection fees can make an already difficult financial situation insurmountable.

- To Prevent Poor Credit Report Marks: Maintaining good credit is an important part of establishing financial independence. Your credit score report is a summary of your credit health. Lenders and other creditors such as car dealers, landlords and even employers rely on the credit report to assess the financial risk of doing business with you. Unpaid student financial accounts that have been transferred to a collections agency is considered bad debt after six months. Bad debt is reflected on your credit score report as derogatory remarks and ultimately results in a drop in your credit score. And, remember, your student financial account is in your name, not your parents, so when it is not in good standing, it reflects negatively on your credit, not your parents’ credit.

- To Ensure Your Overall Health and Well-being: Your overall health and well-being, including your physical, mental, emotional and financial health, is critical to your success. Financial well-being starts with making good financial choices, such as paying all your bills on time. Overdue bills lead to undue stress which can have emotional, mental and physical impact which can also distract you from your studies and your goals of earning a college degree.

What can I do to ensure my account is in good standing?

An Ounce of Prevention is Worth a Pound of Cure: Of course, the best way to tackle financial issues is to prevent them from happening in the first place. Here are some ways you can minimize your risk of nonpayment and consequently, incurring bad debt:

- Build Your Financial Capability: Personal financial management is an important life skill. Financial capability is the attitude, skills, knowledge and self-efficacy to make good money management decisions. UMBC’s FinancialSmarts program offers a range of financial education programs and resources to help students develop their financial capability including topics on budgeting, savings and investment, credit and debt management, retirement, homeownership and more. Research shows that students who engage in financial literacy education see positive effects on their credit scores (https://balancingeverything.com/financial-literacy-statistics/). Click here to learn more about UMBC’s FinancialSmarts initiatives including our online CashCourse, our supplemental CashClips and our one on one CASHCoach program. UMBC also offers a course for academic credit, Financial Literacy 150.

- Have A Plan or Strategy for Payment Prior to Registering: Before you register for an upcoming semester, it’s important that you give serious consideration and thought to how you will pay for your tuition and other educational expenses. You can use our Cost Calculator to estimate your costs. Be sure to factor in all education-related expenses like tuition, mandatory fees, room, board, books, supplies etc. Once you’ve accounted for all expenses, now deduct your financial aid to determine your out-of-pocket cost. You should have a concrete plan for covering your out-of-pocket costs prior to registering for classes and contracting for other services like housing or a meal plan. Your plan may include outright payment of the balance owed once you receive the bill or you may choose to set up a payment plan that allows you to spread your payments out over time (in 2, 3 or 4 month installments). Other strategies for covering your educational expenses include:

- Work/Employment – A summer job or part-time work are both opportunities to build savings that can be used for educational expenses. See employment postings on UMBCworks.

- Employer Tuition Reimbursement/Remission Programs – many employers offer partial or full tuition reimbursement or remission benefits for their employees and their employees’ dependents. Check with your Human Resources Department.

- Finish15: While enrolling in at least 12 credits per semester qualifies you as full-time for billing, financial aid and other purposes, a 12 credits per semester course load will not get you to graduation in 4 years. Remember to Finish15. That is, you’ll need to enroll in and complete at least 15 credits per semester (or on average 30 credits per year) in order to graduate in 4 years. Graduating in 4 years reduces your overall educational expenses and loan debt.

What if I am having financial difficulty paying my bill?

We get it….stuff happens. Despite your best planning, you and your family may find yourselves in a difficult financial situation. Here is some important advice and guidance, should you run into unexpected financial challenges:

- Take immediate action: If you are struggling to pay your bill, you may be inclined to simply ignore bill notices – hoping they will magically go away – but that’s not likely to happen so it’s important to read them carefully and respond. In fact, timing is critical when you’re experiencing financial difficulty as the longer you wait to address the matter, penalties could be accruing – so it’s important to address the matter as soon as possible. Manage and respond to all communications including your Financial Aid To-Do’s, and your student financial account.

- Talk with Your Financial Aid Counselor: You don’t have to navigate this process by yourself; there are individuals on campus who can help. Contact your financial aid counselor and share the circumstances you are experiencing. They are here to help and guide you. Learn who your designated financial aid counselor is here.

- Consider Low-Interest Student Loans:

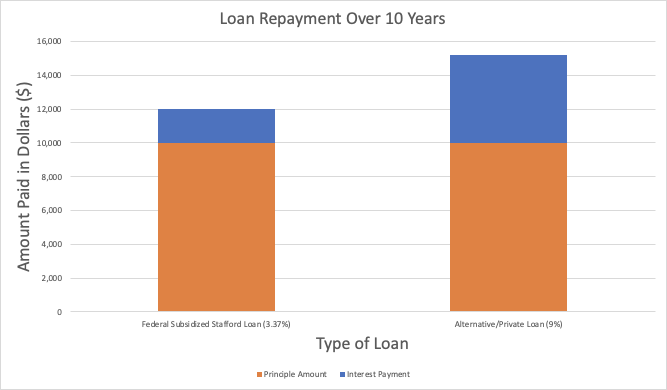

- Your education is an investment in yourself, and loans can be a great option for funding this investment . Student loans, particularly those administered through the federal government, such as the Subsidized and Unsubsidized Stafford Loans, typically have lower interest rates than regular bank loans. For example, with Fall 2021 interest rate of 3.73%, a subsidized Stafford Loan of $10,000 would require you to pay back $1,996 in interest if paid in 10 years after graduation. This means the loan costs you $11,996. However, the same loan amount at an interest rate of 9% (a range could be between 7%-13%), would require you to pay back $16,201. That’s an additional $5,201 beyond the initial amount you borrowed. If you are going to leverage loans, consider leveraging first any federal loans for which you may be eligible.

- Over 5 Years

Federal Subsidized Stafford Loan

Loan: $10,000

Interest: 3.73%

Total Payment: $11,996

Average Personal Loan

Loan: $10,000

Interest: 9%

Total Payment: $16,201

- Adjust Accordingly: If it is apparent to you that you will not be able to secure the resources needed to cover your tuition and other expenses, make adjustments as necessary but pay close attention to the posted deadlines. For example, if full-time enrollment is not financially feasible and you wish to adjust your schedule to part-time enrollment, it will be important that you do so prior to the start of classes. If you do not adjust your schedule prior to the start of classes, you will be responsible for the charges associated with full-time enrollment. For example, the difference between part and full time could be anywhere between $1,032.00 and $6,140.00 for an in-state student in the academic year 2021-2022. Similarly, if you determine you are not able to handle the expenses associated with living on campus, you will need to cancel your license with Residence Life and the Campus Card offices but you should do so by the deadlines outlined in your agreements. If you cancel after the deadline indicated in your agreement, you may be responsible for all or a portion of the charges. For example, if you cancel your housing after August 30th you could owe more than $600.

- Talk with Family and Other Supporters: Those closest to you want to see you succeed. They can be an invaluable resource in helping you strategize on how to secure the resources you need. They may even be willing to provide you some financial assistance but that requires that you talk with them first. When you do, we recommend you present them with a solid plan. Here are a few things you might want to include in your plan:

- A personal statement – Tell your story and provide insight to why pursuing your degree is important to you.

- Be truthful, don’t mislead those that want to support you!

- Your degree plan – Present your four-year, semester by semester, degree plan. Including how you plan to address the challenges that previously impacted your success. You want to inspire confidence that you have a solid plan for completion.

- Career Objective – Be clear about what you hope to do with your degree. Is your plan to do social justice work in your community? Promote art education? Pursue a career in researching medical issues affecting your family and community?

- Financial Need – It’s important that you be very transparent about your financial situation. You want your supporters to feel confident that their financial support will actually make a difference in moving you forward in pursuing your dreams and goals. If you need $1,700 to pay your balance so that you can re-enroll, then you need to be clear about that need.

What if my bill does not accurately reflect my enrollment status?

Students are responsible for the management of their academic careers. They are expected to familiarize themselves with the Undergraduate Catalog and to remain informed of all published degree requirements and deadline dates as outlined in the Academic Calendar. Failure to do so does not provide a basis for exceptions to enrollment and academic requirements or policies.

UMBC recognizes that there are extenuating circumstances that may have impacted a student’s ability to attend or participate in their course(s) that may warrant an exception to policy. UMBC will consider the following Exceptions to Enrollment Policy in cases where the student is able to document 1) enrollment ceased prior to the published deadline and 2) an extenuating and unpredictable circumstance causing a disruption in enrollment and inability to adhere to published deadlines such as military deployment or a medical emergency leading to hospitalization:

- Late drop without a “W” notation

- Late withdrawal with a “W” notation

- Late cancellation of the entire term without a “W” notation

- Late withdrawal from the entire term with a “W” notation

For more information regarding an Exception to Enrollment, contact the Office of Enrollment Management. Note: Petitions must be filed within the posted time frame.

What if my student financial account is sent to collections?

If your student financial account is assigned to collections, here are a few important tips to help mitigate the negative impact:

- Respond Immediately. [Inside Tip: It generally takes a few months before a debt assigned to collections is reported to the credit bureaus so if you’re able to resolve the debt immediately, you may be able to protect your credit score.

- CCU Customer Service:

410-767-1220

askccu@dbm.state.md.us

- CCU Customer Service:

- Establish a Payment Plan. It will be important that you negotiate a payment plan that works for you. Only commit to what you are able to afford.

- Get the Agreement in Writing. Once you have settled on a payment plan with CCU, be sure to request the agreed-upon plan in writing. This helps to ensure that both parties are clear on what your commitment/obligation is.

- Commit to the Plan. It is imperative that you stick with the plan that you negotiated. Skipping a payment may negate the entire agreement and you may find yourself starting back at square one with no flexibility on the part of the collections agency.

- Talk with Your Financial Aid Counselor. There may be loan options to assist with the debt but these should be weighed carefully. By taking a loan, it will be more costly than making payment, since the loan will accrue interest. However, it may be an option to consider if you cannot make payments on a payment plan and need to return to classes to finish your degree.

- Know the Impacts. Once your account is at the state’s collection agency, there are short and long-term impacts. Your credit history will be impacted, making it more difficult to secure credit (in the form of a home loan, auto loan, or private loan) in the future. Some employers check credit history prior to hiring. If you are due a state income tax refund, it will be taken by the state to pay your collections debt.